While the majority of standard loan providers inspect FICO scores to approve a credit card or loan application, particular emerging monetary firms provide debt regardless of your credit history. Aside from the easy, as well as quick accessibility of credit scores, there are several other reasons why such monetary firms are gaining popularity. Among these is the versatility and ease of borrowing for small in addition to high-value requirements. Also, with electronic provisions, a lot of firms supply credit history with a completely online procedure in a matter of minutes.

If you are searching for personal loans for bad credit up to $5000 – Slick Cash Loan, please visit the link.

Nevertheless, some credit rating solutions that provide you simple accessibility to credit history at a breakneck rate may become a credit report trap in the future. Falling into a vicious cycle of financial obligation can adversely affect your credit reliability. As a result, it becomes essential for you to learn about these traps, as well as avoid them to secure your financial security. To make points easy for you, below are some credit scores catches that you should bear in mind while making a borrowing decision.

Get Pay Later Attribute That encourages Spontaneous Spending

Have you ever come across something that you want to get yet don’t have the resources to spend for it right then? BNPL or buy now and pay later, commonly, can aid you in such scenarios. BNPL is an attribute that loan providers use to make it simple for you to spend for your acquisition at a later day either by splitting the price into smaller-sized installments or as a lump sum. You might generally utilize this attribute to buy a smart device, as well as settle the price when you get your salary.

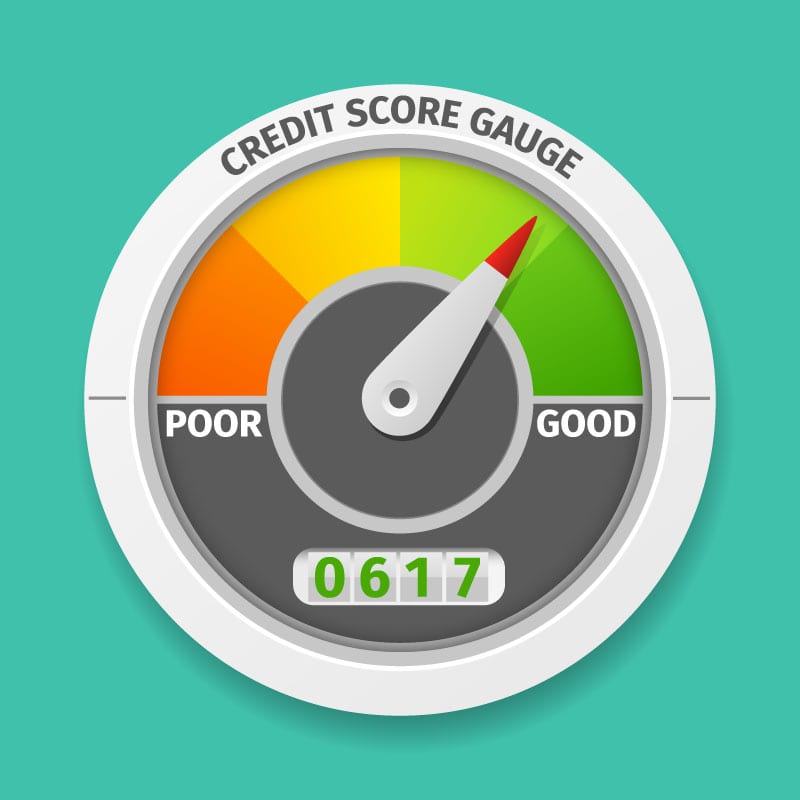

While this can aid, counting excessively on it can result in add-on debt that you may not have the ability to maintain track of. This can then lead to you defaulting on your repayment which can adversely impact your credit reliability and lead to a high rate of interest that might spiral into a debt trap. Examine credit score or FICO score in such scenarios and you will see its result if you are incapable to settle based on the terms.

Cash advance that might lead to you spending past your ways

Cash advances are quick funding services that you can access in times of urgent demand. These finances featured the problem that you repay the quantity when you obtain your income. Nonetheless, these can make you monetarily vulnerable if you do not manage your borrowing appropriately as they provide temporary alleviation. Payday advance loans generally feature a greater interest rate contrasted to typical financings, which can increase your repayment burden. Consequently, you may need to borrow more to settle your existing financial debt.

Comments